Send a message

The region has resources that allow it to be financially independent through own funds, funds allocated by the State and funds originating from the proceeds of borrowings.

The allocation of these resources guarantees the regions to serve the powers devolved to them under Organic Law 111-14.

Thus, the state allocates to regions under finance laws in a progressive manner :

- 5% of proceeds from corporate tax;

- 5% of proceeds from income tax;

- 20% of proceeds from insurance contracts tax.

On this basis, at the beginning of each term, the Regional Council draws up a three-year budget based on a mission-oriented strategy that it has set for the current year.

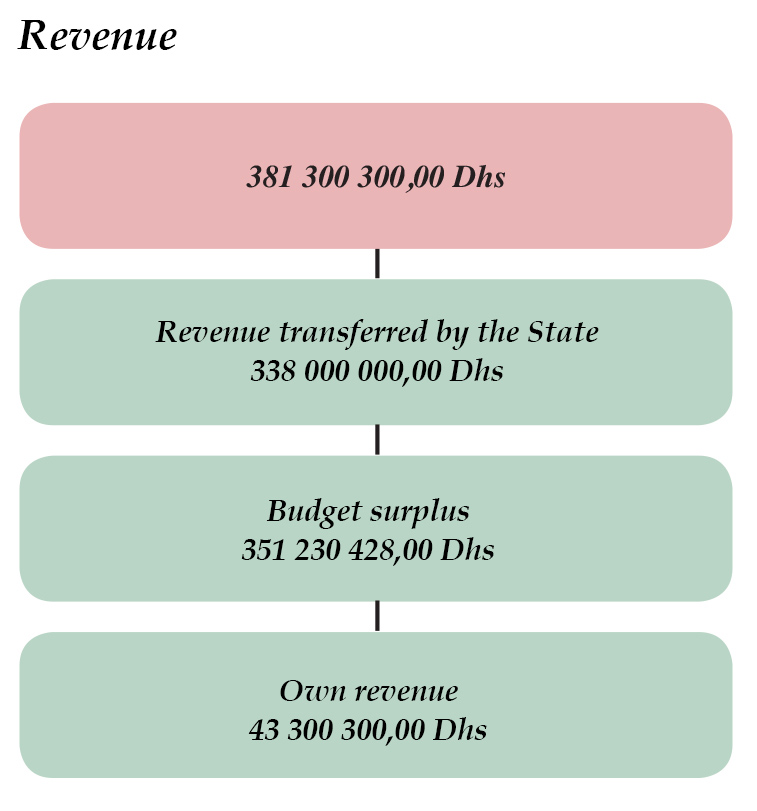

The allocation of budgetary revenues for the next three years was as follows:

- Year 2016: 338,000,000.00 Dhs

- Year2017: 465,000,000.00 Dhs

- Year2018: 572 000 000,00 Dhs

These sums cover the operating and investment costs of the Regional Council.

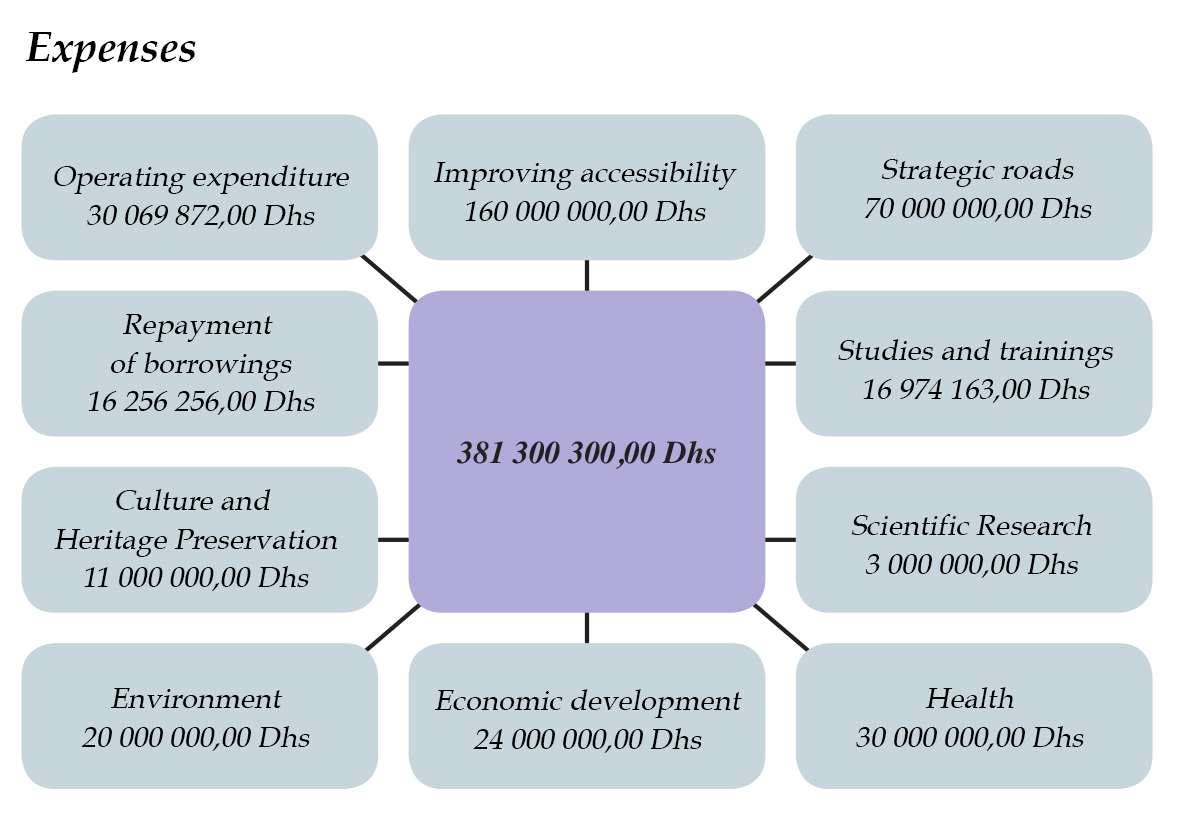

Revenue and Expenses of the Souss Massa Region for the year 2016

Resources of the Region:

The resources of the Region include:

- The resources of the region include per capita tax or tax quotas that the state reserves to the region under the laws of finance, in particular with regards to corporation tax, income tax and insurance contracts tax;

- Financial allocations from the state budget;

- Per capita taxes that the region is entitled to cash under the legislation in force;

- Proceeds of royalties created in accordance with the legislation in force;

- Income revenue from services.

- Proceeds of fines in accordance with the legislation in force;

- Farm products, royalties and dividends as well as resources and revenues from the financial contributions of institutions and enterprises from the region.

- Supplies granted by the State or legal persons under public law;

- The proceeds of authorized borrowing;

- Income from properties and shares;

- The proceeds from the sale of movable and immovable property;

- Aid and gift and legacy funds;

- Different revenues and other resources established in the laws and regulations in force.

Costs include:

- Budget expenditure: management and preparation charges.

- Ancillary charges.

- Expenditure in special accounts.